07 Mar 2024 China Is No Longer the Default Source of Product and Has Become a Threat to Many Companies

The surge in China costs requires Nearshoring.

Written By Jeffrey Cartwright, Shoreview Managing Partner | 7 min read

China as a Place for Companies to Invest in Manufacturing Has Faded

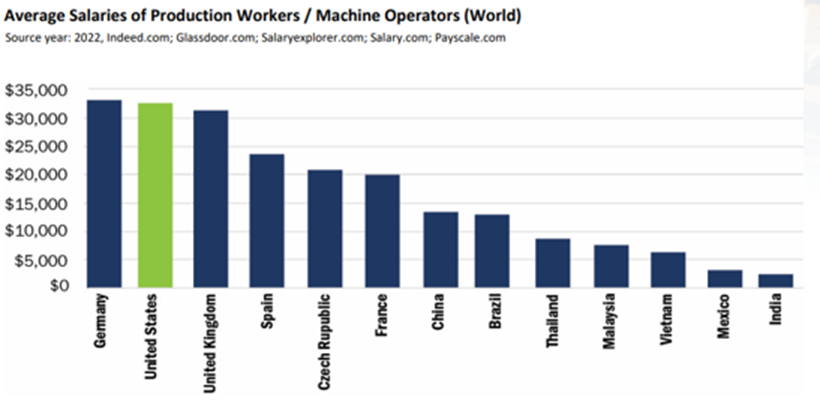

Historical trends have positioned China as a bastion of low-cost manufacturing, an optimal region for production and exportation. However, recent shifts in the global economic landscape have begun to diminish this once clear-cut advantage. Today’s executives must confront the reality that the economic benefits once associated with China are fading, a shift substantiated by the accompanying graph, which depicts the rise of China’s labor costs in stark contrast to Southeast Asia, India, and Mexico—all of which now offer more competitive labor rates for production workforce.

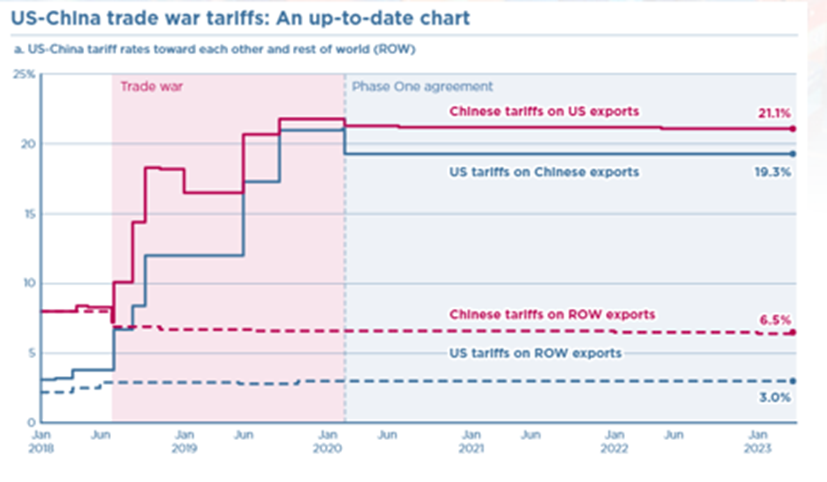

Furthermore, the persistent trade disputes between China and the United States introduce additional layers of complexity. It is critical to underscore that tariffs and duties imposed on U.S. goods entering China have historically exceeded—and continue to exceed—those applied to Chinese imports to the U.S., a pattern consistent with China’s trade relations with the Rest of the World (ROW).

Finally, shipping logistics have faced significant upheavals due to the ongoing global pandemic, compounded by geopolitical disruptions such as the Houthi attacks impacting maritime routes in the Red Sea. These compounding factors are reshaping the commercial terrain, underlining the urgency for corporate decision-makers to adapt to these evolving challenges with informed strategies and decisive action.

China as a Source of Revenues and Profits

One of the primary motivations prompting companies to increase their investments in China has been the allure of tapping into its vast and dynamically expanding consumer and industrial sectors. However, this strategy has not yielded the long-term benefits that many organizations anticipated. Indeed, the initial promises of market dominance have dwindled, and there is a burgeoning concern among leading corporations regarding a discernible decline in their market share and profitability. The shifting economic landscape raises an urgent call for reevaluation of market entry strategies, underscoring an imperative for astute market analysis and adaptive business models to foster sustainable growth and competitive resilience in the challenging Chinese marketplace.

U.S. Company Harmed by Requirement for the Transfer of Technology and Knowhow in Order to Operate in China

Westinghouse Electric Company, a trailblazer in nuclear technology, encountered significant challenges during its venture in China. The 2008 partnership with China National Nuclear Corporation (CNNC) to build advanced AP1000 nuclear reactors marked a substantial technology transfer, as compliance with local laws necessitated Westinghouse to relinquish thousands of proprietary documents. However, the transaction was marred further by cyber incursions in 2010, with Chinese hackers pilfering additional sensitive design information. Fast forward to 2019, China unveiled its indigenous Hualong One design, and by 2023, all 21 nuclear reactors under construction were of Chinese design—a stark contrast to a decade prior when Westinghouse was a market leader, now without a single new reactor project in the interim.

The automotive sector, headlined by General Motors, mirrors this trend, witnessing a precipitous decline in market share within China—from 14.9% of light vehicle sales in 2015 to just 9.8% by 2022. This decline is multifaceted; it tracks not only the rise of a robust domestic auto manufacturing infrastructure, bolstered arguably by appropriated intellectual property and coerced technology sharing, but also the stirrings of nationalistic sentiments spurred by China’s assertive economic strategies such as “China 2025”. These factors, coupled with the explosive growth of China’s electric vehicle (EV) sector—a market where local firms outpace General Motors—paint a landscape of diminishing returns for traditional auto giants in what was once considered their growth bastion.

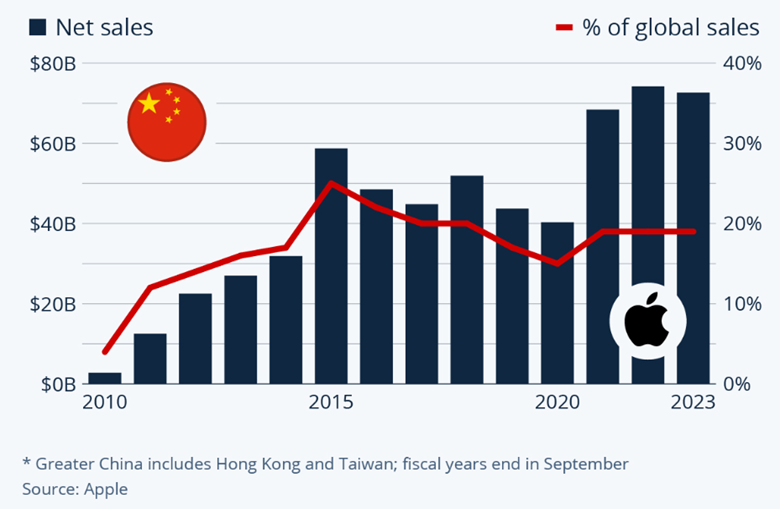

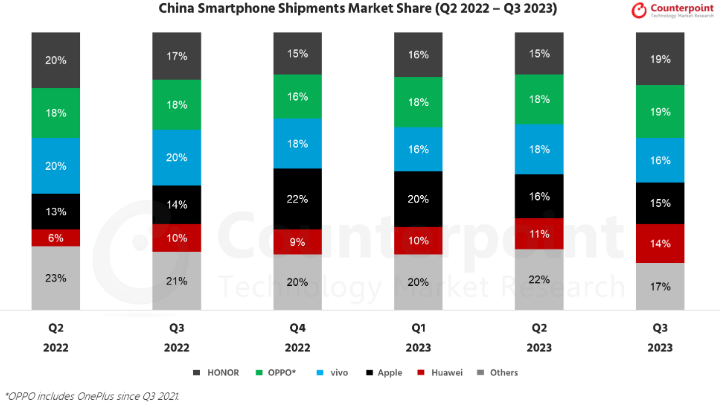

Apple Inc., heavily reliant on China for nearly a fifth of its sales, grapples with its own set of obstacles. In a contracting smartphone market riddled with talks of government-led iPhone bans, stakeholder apprehension is palpable.

Market share dynamics exhibit this tension—where once-prohibited Huawei has clawed back with a 41% year-over-year sales increase anchored by its Mate 60 series, contrasted by Apple’s nominal sales growth and a 20% to 16% Chinese market share contraction, equivalent to a 25% loss.

The aerospace industry isn’t exempt from these tremors. Amidst safety controversies and the 737 MAX’s tarnished reputation, Boeing cedes ground to Airbus and, more ominously, China’s COMAC. The latter’s foray into commercial aviation with homegrown C919 and ARJ21 airliners—and the clinching of orders from global operators at the Singapore airshow in 2024—signals potential upheaval. The question looms for Boeing and its Western contemporaries: how might China’s economic fervor shape the future of aviation?

Indeed, China’s ascent to preeminence extends beyond the above. In realms such as Lithium-Ion batteries, rare earth minerals, and pharmaceuticals—industries where it currently leads global production—it replicates a pattern observed across multiple sectors: rapid ascension following technology acquisition, paving the path towards dominance.

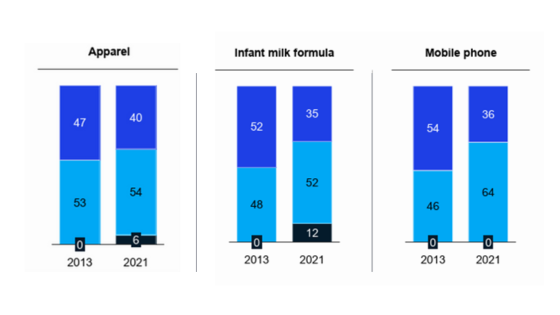

For consumer brands, anecdotal and McKinsey-backed evidence prod at a tangible reorientation towards local entities. A synthesis of heightened product quality and surging national pride underscores the transition from foreign to domestic allegiance, an inflection point for multinational entities operating in an increasingly self-sufficient China.

Economists’ Claims that there Has to Be Continued Partnership with China in Global Trade are Wrong

Leading economists suggest that China’s current economic dominance makes global decoupling unlikely, at least in the near term—but this need not be a permanent state of affairs.

Consider the case of Japan. In 1995, Japan’s GDP was a staggering 73% of the United States, leading many to speculate that it would not be long before Japan overtook the US economically. However, fast forward to 2023, and Japan’s GDP has dwindled to a mere quarter of the United States. Once a cautionary tale of economic forecasts gone awry, Japan’s previous economic trajectory bears a striking resemblance to China’s current situation, which in 2022 also reported a GDP constituting roughly 73% of the United States.

For years, a similar chorus of economists has projected that China’s burgeoning economic profile would eventually surpass that of the United States. Yet, the evidence is mounting that China’s economic growth has reached its zenith and is now contending with formidable headwinds rooted in demographic challenges, among other factors.

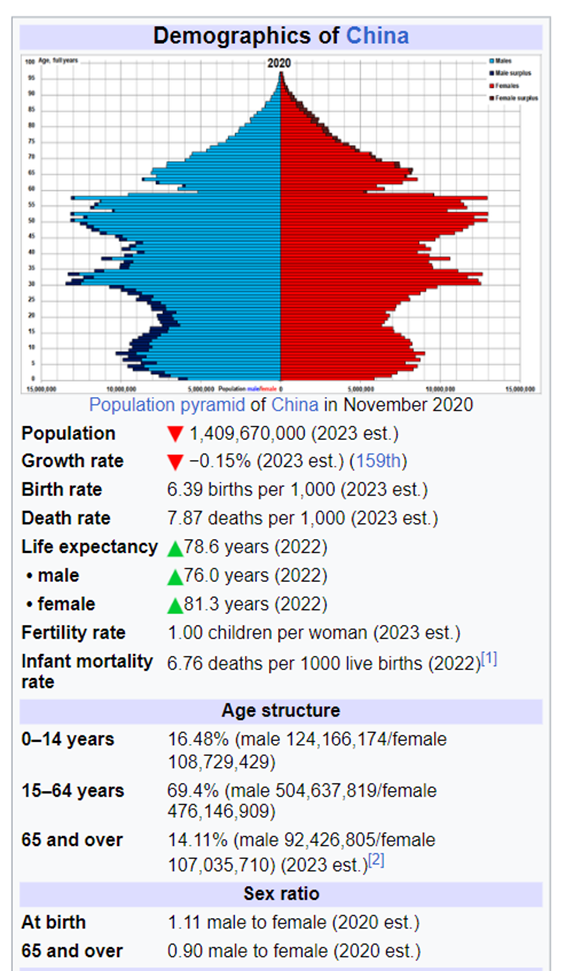

The repercussions of China’s one-child policy, which has only recently been rescinded, will be profoundly felt in the imminent labor market shift. We’re poised to witness approximately 28 million individuals exiting the workforce into retirement in 2024 alone, with a forecast of 300 million over the following decade. The worker-to-retiree ratio, which stood at 5 to 1 in 2020, is anticipated to plummet to 2.4 to 1 by 2035 and even further to a stark 1.6 to 1 by 2050. This disproportionate population aging will necessitate a substantial reallocation of resources toward eldercare, inevitably diminishing the funds available for reinvestment within the broader Chinese economy.

What we are facing is a palpable and potentially irreversible slide in China’s demographic structure, leading to a postulated decline in population from today’s 1.3 billion to a projected 800 million by the end of the century. The message here is unequivocal for executive leaders and carries significant implications for global investment, supply chain strategies, and international commerce. The impending demographic shifts in China are not just predictive analytics; they represent a clarion call for businesses to reassess their long-term plans in relation to the world’s second-largest economy.

The U.S. Will Reinvent Itself as It Has Since Its Founding

Throughout history, the U.S. has shown remarkable adaptability, notably seen during the dramatic transformation in the 1940s. From a modest military rank in 1939, the U.S. rose to global prominence by the end of World War II as the “Arsenal of Democracy.” Today, shifting away from China as the main global factory signals a move towards regional manufacturing strategies, offering resilience and benefits.

Corporations heavily reliant on China’s low-cost manufacturing must rethink their sourcing strategies, considering options like Re-Shoring to the U.S. or Near-Shoring to Mexico for robust supply chains. Shoreview Management Advisors leads this transition, supporting Mexican factories and U.S. companies in sourcing. With a proven track record and extensive experience, partnering with Shoreview is crucial for success in the evolving manufacturing landscape.

Strategic partnerships with Shoreview Management Advisors are essential for long-term success in a new manufacturing and supply chain era. Adaptation and strategic planning shape the future of global manufacturing. Join the evolution at Shoreview Management Advisors.