16 Aug 2022 COMPETING IN THE BLUE OCEAN OF PROFITS OR THE RED OCEAN OF INTENSE COMPETITION

Blue Ocean Strategy by W. Chan Kim and Renee Mauborgne Provides a Framework with which to Review Most Manufacturers in Mexico

By Jeffery Cartwright, Shoreview Advisors | 10 min read

The book’s authors show companies how to expand by creating new market spaces or industries with little or no competition. Most companies, however, compete in the “red ocean”, a space bloodied by intense competition. Achieving profitability in this red ocean is based upon lowering cost, improving quality, and/or reducing lead times, all of which competitors can replicate. The essence of the strategy is to make your competition irrelevant by breaking out of the red ocean and creating or meeting uncontested new demands. The company then has a substantial lead over any competition that follows.

Existing State of Most Manufacturers in Mexico

- Most factories are competing in the existing market space of existing demand. In the case of Mexico, most of them are manufacturing components or assemblies for a US company to the defined specifications of the current client company, which is then marketing and selling the fully assembled product.

- The factory must execute high-quality production with a competitive cost structure.

- In many cases, there are a fair number of factories with similar manufacturing capabilities, resulting in thin margin opportunities due to rabid competition. Further, the premise is that there are only so many existing potential customers that competitor factories compete intensely to acquire or retain.

- Improving profits is only possible through greater investment in more efficient equipment.

- Efforts to improve quality, profits, or lead times can be easily matched by other companies as the technology is readily available and quickly matched by others.

Overall, the largest manufacturing companies in Mexico serve some portion of the US automotive, aerospace, or medical device industries. In each of these, quality, cost, and delivery have been refined over the last two decades, limiting opportunities for differentiation. To gain market share is to under-bid the competition.

The other major issue is that Mexican manufacturing companies have become so entrenched in this present state that it is difficult for them to envision any other. With China’s entry into the World Trade Organization, many companies competing by differentiating products were destroyed by the US demand for lower prices. Many Mexican owners believe that they cannot be competitive with China, so they have focused on the market where they have been successful, manufacturing for US companies within these large industry segments.

The author of Blue Ocean Strategy would describe this business environment as swimming in an ocean of red. Sometimes, businesses lose their edge and begin to produce losses instead of profits.

Blue Ocean

The blue ocean is defined as a business environment with zero or at least very few competitors delivering a solution to an unmet need. For this article, it does not have to be an entirely new market space for the world, just a new market space for Mexican manufacturing companies who have mentally yielded the supply of products to China over time.

Essentially, Shoreview Management Advisors is suggesting that progressive thinking manufacturing companies in Mexico should create factors that have not been seen before in Mexico. These factors may be in China or had been seen before China entered the World Trade Organization (WTO), underbidding Mexico then because of cheap Chinese labor and heavy industry subsidies from the government of China. That is not to say that Mexico will be able to overcome all of the heavy subsidies. Still, it has definite advantages in labor and logistical costs relative to China and other Asian countries.

Several Core Competencies or Enabling Processes which Provide New Opportunities in and for Mexico

After years of escalating labor costs in China, imposition of up to 25% tariffs, and the major disruptions to the supply chain from Asia due to the COVID pandemic and now the Russian invasion of Ukraine, many US companies are determined to move to Mexico and reduce the significant risk of sourcing from Asia.

However, there are missing competencies in Mexico. Forward-looking factory owners that step in to acquire technologies and capabilities that will meet those missing needs will have several years of competitive advantage. Perhaps in becoming the sole provider of such products, there can be complete localization of product supply chains in North America. Entering the Blue Ocean means extraordinary growth and profits for those factory owners.

- Factories are needed that can reverse engineer products being made in China. Many US companies have evolved into marketing and distribution companies. They have outsourced manufacturing to China for so long that they do not know how to manufacture a product, nor do they possess drawings to allow someone else to create the tooling. Since most factories in Mexico have been execution only and given the drawings from major US firms, they are not accustomed to having to re-create or reverse engineer, that which exists as perhaps only a physical sample.

- Another need is the ability to manufacture printed circuit boards that are part of a finished product in China and create the appropriate specifications required for manufacturing in Mexico. Usually, the outsourced Chinese manufacturer is still using through-hole technology. There is a need to adapt the printed circuit board to the dominant surface mount technology that is readily available in Mexico. Again, the issue is that US companies have outsourced circuit board manufacturing and design to China. This is even more complicated because a Chinese manufacturing company may be vertically integrated.

- Fractional AC motors were produced at several companies in the United States and China before they were outsourced to China due to labor costs. There are a number of AC motor manufacturers in Mexico, but they all produce larger ones and will not invest in fractional ones in Mexico. Part of the reason for outsourcing is that these same companies own factories in China, believe that tariffs are temporary, and that the cost of manufacturing in Mexico will be too high. This information is outdated, as the labor cost in Mexico has been less than in China since 2015. Fractional DC motors are also missing from Mexican manufacturing. This is a more complex issue, as rare earth magnets that are required are nearly a monopoly manufactured in China.

- Lithium-ion batteries that power small devices from power drills to lawn mowers are currently sourced entirely from China. Many US companies are moving these tools, and outdoor lawn and garden products back to the US, or exploring Mexico.

- There are many world-class manufacturers with certifications such as ISO, IATF, aerospace, US FDA, etc., in Mexico. There are also great assembly plants. Many of these are part of the very strong Maquiladora industry and, as such, are captive manufacturing operations of the larger US company. They are accustomed to receiving parts from other factories and assembling them into a more complex product.

The opportunity is for a strong contract manufacturing plant to also provide assembly with a competitive cost structure. Take the example of a strong stamping operation, metal fabricator, or injection molding company. They pay a fair wage (competitive with China) for a skilled operator. That same wage is often paid to a relatively unskilled assembly worker (and that wage rate is 2 to 3 times the cost of unskilled labor in China), which is not a problem for many products. However, when the production process requires 5 skilled operators and 35 assembly workers paid comparably, this product will not be competitive with China. In moving finished products out of China to Mexico, which utilizes more of the low number of skilled operators and a high number of assembly workers, there is a significant growth opportunity for Mexican companies. There is a great lack of two-tiered wage structures based upon skills in Mexico. The border areas with less labor availability are problematic due to this relative overpaying for assembly workers.

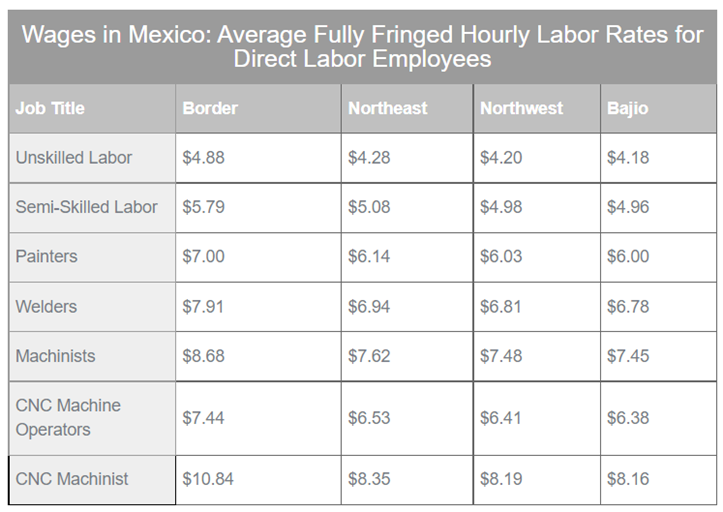

In Central Mexico, labor is more available; therefore, the wage structure is competitive with Asia. Locating those Mexican factories with a two-tiered wage structure based on high-skilled operators and low-skilled assembly workers is an opportunity for many factories. Below is a table of factory wages in areas of Mexico.

An example is if a manufacturing/assembly operation requires 40 workers in China with 5 skilled operators ($10 per hour) and 35 unskilled workers ($5 per hour), the combined operations would cost $225 per hour of production. But if there was a two-tiered wage structure in Mexico with 5 skilled operators ($8 per hour) and 35 unskilled workers ($4 per hour), that would only cost $180 per hour of production (20% lower than in China). In a less flexible factory with a single wage structure, all workers would cost $8 per hour, and the total cost then is $320 per hour of production (42% higher than in China), which means that the manufacturing of this product is likely to stay in China. On a low-cost product producing 40 units per hour, the cost per unit is $5.62 in China, $4.50 in a flexible two-tier factory in Mexico, and $8.00 per hour in a single-wage factory.

Suggestions for Mexican Manufacturers

The above 5 opportunities represent areas with zero to very few factories in Mexico. This represents a Blue Ocean opportunity for factories to compete in a product not currently produced in Mexico or with very few factories participating today.

Companies relocating from China to Mexico would highly prefer to 100% localize production in Mexico as it greatly simplifies supply chain complexity. However, companies may be willing to pay marginally more in Mexico, but they will not pay a large premium for the advantage of geographical proximity.

Beyond the above, there are other areas where China dominates manufacturing, and little to no North American competition. These are more in the medium level of difficulty and require more intense design efforts between the US marketing companies and the Mexican factory partners. These would include silicone injection molding and synthetic textile production.

Other Strategic Competencies Are Being Addressed in the United States that Will Benefit a North American Business Ecosystem

There are other industries in which the United States has become too dependent upon China. These also represent potential areas of opportunity for Mexico however, they are much more capital or resource intense. These include semiconductor manufacturing, lithium-ion battery production for electric vehicles, lithium, and rare earth mining.

If you’d like to learn more about re-shoring your production from China to Mexico, please contact us.