29 Apr 2024 Mexico vs China Manufacturing: A Logistics Comparison

Written By Troy Patterson, Visigistics Reliable Logistics | 8 min read

Choosing between Mexico and China for manufacturing presents a tough decision for businesses. With the rising trade volume between the United States and Mexico, companies are looking to minimize disruptions and geopolitical risks in their supply chains. Mexico’s proximity to the US offers supply chain advantages over China, making it an appealing choice for optimizing manufacturing operations. However, factors beyond production costs, like total landed costs, must be considered when comparing manufacturing in Mexico versus China. This article delves into key considerations for businesses deciding between Mexico and China manufacturing, focusing on the differences in shipping from suppliers in each country to the US. Explore transit modes, times, and costs with us.

Modes of Transportation: China vs Mexico

When transporting goods to the US, reduce your shipping expenses by opting for Mexico instead of China. While China has certain benefits when it comes to ease of projects and manufacturing, the reality is that the shipping options are limited to ocean freight and air freight.

Thanks to its strategic geographical position and highly efficient transportation networks, Mexico emerges as a highly cost-effective alternative for businesses aiming to penetrate the US market. Mexico offers a plethora of transportation modalities, such as over-the-road trucking, which provides direct and flexible shipping routes; rail systems, known for their capability to move large volumes of goods efficiently; ocean freight, ideal for bulk shipments; and air transport for time-sensitive deliveries. This diversity in transportation options positions Mexico as a premier and accessible hub for companies seeking to streamline their shipping processes and costs to the US.

Transit Times: China vs Mexico to the US

Shipping from Mexico to the US offers a significant advantage in terms of speed when compared to shipping from China, largely due to the geographical proximity of Mexico to the US market. This proximity facilitates shorter transit times, which is crucial for businesses that rely on the timely delivery of goods. Transit times can vary widely, however, depending on a range of factors including the chosen shipping method and various logistical considerations that come into play during the shipping process.

For instance, shipments originating from Shanghai and destined for Los Angeles via ocean freight typically take between 15-20 days, contingent upon the efficiency of cargo handling at both the departure and arrival ports. Conversely, when these shipments are directed towards New York City, transit times can extend to a range of 25-30 days. These estimates can be impacted by unpredictable factors such as port congestion, which can greatly delay the unloading of goods, and adverse weather conditions, which can disrupt shipping schedules. However, these estimates are subject to factors such as border processing times, Panama Canal traffic, road conditions, railroad delays, and customs clearance procedures.

In stark contrast, shipping goods over-the-road from Mexico City to Dallas is markedly quicker, with transit times usually falling within a 2-3 day range. This expedited transit is possible due to the direct land routes that connect Mexico and the US, eliminating the need for lengthy sea voyages. Even for longer distances, such as shipments to New York City, the transit times are impressively short, typically around 4-5 days. This efficiency presents a valuable opportunity for companies to streamline their supply chain operations, ensuring that products reach their destination in a timely manner.

When planning their supply chain strategies, companies must carefully consider these variables to optimize their delivery schedules. It’s not just about choosing the fastest shipping method; it’s also about understanding and mitigating the potential delays that can occur. Below is a detailed table that outlines typical transit times between key cities in Mexico and the US, providing a comprehensive overview for businesses looking to make informed decisions about their shipping options.

International Shipping Logistics

When comparing international shipping from China and Mexico to the US, the differences in container sizes between China and Mexico present distinct logistical considerations. Ocean containers from China are typically standardized at 20 feet, 40 feet, or 40 feet High Cube (HQ). Conversely, trailers and rail containers commonly used in Mexico and the United States are longer, measuring 53 feet. This variance in trailer and container dimensions holds crucial implications for cargo capacity and costs per unit. Notably, goods transported on trailers from Mexico benefit from the larger container size, allowing up to 50% more items to be carried compared to shipments from China. This advantage becomes particularly pronounced when shipments don’t reach maximum weight capacity, optimizing space utilization and enhancing cost-effectiveness for businesses engaged in cross-border trade.

Significant cost-saving advantages can be gained by opting for full truckload (FTL) shipping for your cross-border logistics needs, especially when compared to the traditional ocean freight routes. It’s impossible to ignore the financial benefits of importing goods using a spacious 53-foot trailer from Mexico and which will reduce shipping costs by an impressive 33%. This comparison not only highlights the immediate cost reductions but also sheds light on the potential for increased efficiency and faster delivery times. By choosing FTL shipping, businesses can enjoy the dual benefits of cost savings and improved logistics performance, making it a compelling option for those looking to optimize their supply chain operations.

Shipping Cost Factors

Ocean Freight

Ocean container pricing operates within a complex framework influenced by various factors. Typically, pricing is determined by shipping volume, container size, route, shipping company, fuel costs, demand, and market conditions. As stated above, container sizes commonly used in international shipping include 20-foot and 40-foot containers, with the latter being the most prevalent.

Shipping companies offer different pricing structures, including spot rates and contract rates. Spot rates fluctuate based on market conditions and are typically higher but offer flexibility for shippers. Contract rates, on the other hand, are negotiated agreements between the shipping company and the shipper for a specified volume and duration, often providing stability and potentially lower rates. However, contract rates also have penalties if the volume agreements are not met.

Surcharges such as fuel surcharges, peak season surcharges, and currency adjustment factors may apply, adding to the overall cost. The competitiveness of the shipping market, geopolitical events, and regulatory changes can also impact pricing dynamics.

COVID Crisis

During the COVID-19 pandemic, the average container prices experienced a remarkable surge, reflecting the profound disruptions in global trade and logistics. The outbreak led to widespread lockdowns, port closures, labor shortages, and disruptions in supply chains worldwide. As a result, demand for shipping containers surged, driven by increased e-commerce activity, stockpiling of essential goods, and a surge in demand for medical supplies.

Significant disruptions in container availability occurred, with many containers stranded at ports or in transit due to logistical bottlenecks. The imbalance between supply and demand caused container prices to skyrocket, reaching unprecedented levels, with many companies in the US paying over $20,000 per container. Shipping companies and freight forwarders faced immense pressure as they struggled to meet the surging demand while grappling with soaring container prices, exacerbating the challenges faced by businesses reliant on international trade.

Global Considerations

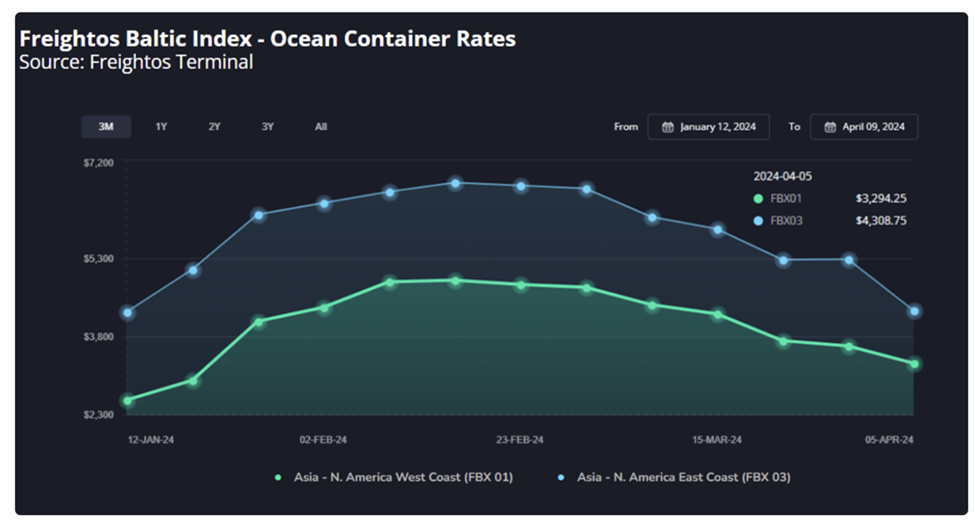

While ocean freight rates have returned to near pre-2020 rates, the conflict in the Middle East and the push to get manufacturing orders shipped before the Chinese New Year in 2024, has perpetuated another significant jump in container rates, compounding the challenges already posed by the COVID-19 pandemic. The conflict in the Middle East led to heightened geopolitical tensions and disruptions in key shipping lanes, affecting the smooth flow of maritime trade.

At the same time, the drought in the Panama Canal resulted in restrictions on vessel drafts, limiting the passage of larger ships and necessitating alternative routing for ocean freight. These combined factors created bottlenecks and delays in global supply chains, exacerbating container shortages and driving container rates to new levels not seen since late 2022. As shipping companies navigated through these tumultuous waters, businesses faced heightened uncertainty and escalating costs, underscoring the vulnerability of global trade to geopolitical and environmental disruptions.

The potential conflict between China and Taiwan poses a significant risk to ocean pricing and global trade. If China were to invade Taiwan, it would likely trigger profound disruptions and uncertainties in maritime shipping, potentially leading to trade sanctions, embargoes, and other measures that could disrupt supply chains. The heightened geopolitical tensions and increased risk could result in higher insurance premiums for vessels transiting the region, further adding to shipping costs. Supply chain disruptions, port closures, and increased transit times due to heightened security measures could tighten vessel capacity and surge demand for shipping services, driving a significant spike in ocean pricing through increased freight rates, surcharges, and other related costs. However, as of this writing, such a conflict has not occurred, and a 40-foot container from China can cost anywhere from approximately $4,000 to $8,000 delivered, depending on origin and destination locations, port fees, chassis rentals, and other customs clearance fees. This cost range does not include any applicable tariffs on the goods or potential detention and demurrage charges often associated with steamship containers.

Mexico Shipping Cost in Review

The cost of shipping from Mexico to the US can vary depending on several factors, including the weight and dimensions of the shipment, the shipping method chosen (air, sea, or ground), and the urgency of delivery. Other factors, such as customs duties, taxes, and insurance, can also contribute to the overall cost of shipping.

If looking at full truckload shipping to compare against Ocean Containers from China, the key drivers for cost are the distance between the origin and destination and the supply and demand for equipment in the given origin and destination areas.

For example, manufacturing in Tijuana and shipping to San Diego will typically cost $350 per truckload for a 20-mile journey. Monterrey, MX, to the Dallas-Fort Worth area costs in the $2600 – $2800 range. While shipping from Guadalajara in the state of Jalisco, Mexico, to the state of New York can cost upwards of $9,000. So, as you can see, the prices vary greatly.

The Impact of Shorter Transit Times on Supply Chains

Manufacturing in Mexico has the potential to revolutionize supply chains. Companies can drastically reduce inventory levels by relocating production facilities closer to the U.S. The proximity enables a more agile response to demand fluctuations, minimizing the need for excess stockpiling. Moreover, shortened distances lead to faster transportation times, enhancing planning cycles and allowing for more accurate forecasting. As a result, companies can optimize their production schedules, efficiently meeting market demands while minimizing overproduction.

Additionally, this streamlined approach translates into improved cash flow management, as capital is no longer tied up in excessive inventory or lengthy transit times. Overall, the strategic shift toward closer manufacturing promises not just cost efficiencies but also resilience and adaptability in an ever-evolving global marketplace.

Total Landed Costs Comparison

In conclusion, when comparing logistics costs between shipping from Mexico to the US versus China, manufacturers must do a thorough analysis of total landed costs as well as evaluate the benefits and risks of Mexico vs China Manufacturing. If you are looking for help determining total landed costs for Mexico vs China Manufacturing, contact us today. We would be glad to help you determine whether Mexico is the right manufacturing location for your goods.