03 Jun 2024 MEXICO WINNING ITS SHARE OF THE GLOBAL MANUFACTURING PIE

Written By Jeffery Cartwright & Lawrence Allen | 15 min read

“Know the enemy and know yourself; win a hundred battles. Ignorant of the enemy, but know yourself; win half your battles. If ignorant of both of the enemy and yourself, lose all your battles.”

― Sun Tzu, The Art of War (Paraphrased)

Today it is even more impracticable for China to abjectly slam their doors shut to the outside world; its export industry is central to economic growth and preserving its pact with the Chinese people. Barring some catastrophe, China will not be taking itself off the field.

CHINA’S PUSH FACTOR

The great global recession of 2008 resulted in a precipitous decline in demand for exports from China. The Chinese Academy of Social Sciences described the impact: “China’s economic growth is over-dependent on the growth of net exports. In 2008, its export-to-GDP ratio reached 32%… with labour-intensive export industries absorbing non-skilled workers from rural areas.”

This article will offer and examine strategies and tactics for Mexico winning its share of the global manufacturing pie through successfully regionalizing manufacturing from far-flung locations such as China. It will present knowledge and perspective that will enable business leaders to better understand the vulnerabilities and capabilities of both China and themselves—relative to the opportunities. It will provide an understanding of where China is in its modern industrial revolution and the actions it is likely to take to retain and continue to attract manufacturing to its shores. And it will analyze Mexico’s strengths and weaknesses in terms of manufacturing, but also its ability to “think global and act global” at the governmental, corporate leadership and cultural levels.

Of concern were shuttered factories idling hundreds of thousands of contract workers en masse, who were originally brought from remote country-side villages by labor scouts to work on year-long contracts in manufacturing cities like Shenzhen. The situation posed serious risk of domestic unrest, so much so that government representatives were deployed with vouchers, busses, military transport and train passes to move idled workers back to their rural hometowns as quickly as possible.

The 2008 unemployment crisis was managed, but China’s GDP at the time was under US$5 trillion—about a quarter of what it is today. The country’s manufacturing geographic footprint has expanded across all industries and is no longer contained within tightly clustered special economic zones along China’s eastern and southern coasts. And, not only has China’s economy grown exponentially over the past 16 years, so have the expectations of hundreds of millions more people who have migrated from a 19th-century rural agrarian lifestyle to a 21st-century city lifestyle.

Today, these multitude are well past the threshold where—as Thomas Wolfe’s 1940 book You Can’t Go Home Again 2 so eloquently explains—it is possible to move back to the countryside after having lived in the big city. In short: for the current employment crisis in China, 2008 solutions will not work. The CCP has to find new solutions.

Employment First

The scale of China’s employment challenge is immense. In addition to keeping jobs for the existing workforce, the China Daily reports that China graduates 11.6 million college students and 15 million new laborers enter China’s job market every year. To keep up, the Chinese government has created its “Employment First Policy:” a range of policies that support skills training and job placement.

Jin Siqi from the South China Morning Post:

“In China, more than 80 per cent of urban employment is created by the private sector. Beijing is touting a new strategy intended to create jobs and clear labour-market obstacles for yet another record number of university graduates, offering more government support in employment services and technical training.”

This is all well and good, but to make this happen China’s economy must support the number and quality of jobs for them to go to.

Walking the Razor's Edge

China’s social contract is that the CCP gets to retain total authority in exchange for the people demonstrably becoming financially better off year on year. Dr. Sarah C. Paine, professor of strategy and policy at the U.S. Naval War College explains: “The communist party wants to maintain its monopoly on power. Now, we’re at the inflection point where you have a lot of educated people, and businesses that are integrated into the world that want to make autonomous decisions. But for the CCP that’s off the table.” 3

Richard Nixon, the U.S. President who arguably understood China best, naturally saw it through a national government lens: “As far as the Chinese are concerned, their primary interest is China, always China. That’s number 1. Their secondary interest is philosophy. So when there is a conflict between their ideology and their security, their security always comes first.” 4 In Nixon’s time it was security vs. ideology, rather than today’s security vs. prosperity, but the principle is the same.

On the security (CCP preserving its absolute authority) side of the equation, Dr. Payne sees bad trends: “China’s most talented entrepreneurs are being “relieved of their enterprises.” It [CCP] used to claim the moral rectitude and economic growth card. Well, that one’s going away, so they are left with one card: the nationalism card…a unifying thing for Chinese.”

On the prosperity side, China understands all too well that a nation can never be selfsufficient, and that prosperity is inexorably tied to being engaged with the global economy. They learned this the hard way when attempting total isolation 1949-1978, leading to its descent into regression, poverty and literal starvation. Today it is even more impracticable to abjectly slam their doors shut to the outside world; its export industry is central to economic growth and preserving its pact with the Chinese people. Barring some catastrophe, China will not be taking itself off the field.

Reality Is Becoming Perception

But China only holds its own cards at the global manufacturing poker table. For foreign businesses, manufacturers and investors the call for Chinese nationalism is a siren call—inciting some to head for the door. Greg Brown, Chairman and CEO of Motorola Solutions, stated in an interview with Fox News Business Journalist Maria Bartiromo: “Motorola [once] had $3.5 billion of revenue in China and 15,000 employees. Today we have virtually no revenue and 50 employees. So after these [intellectual property] infractions, going back a decade and a half ago, we made the decision: get out of China. It’s not a productive market, they don’t play on even terms, the Communist Party leads the theft of intellectual property and patents…we’ve left that market.” 5 Motorola Solutions is only one of a number of multinational companies adjusting, paring or even exiting their China operations altogether. Early this year Reuters reported that BASF announced that it would be selling its stake in 2 joint ventures in Xinjiang, “after rights groups documented abuses including forced labor in detention camps.” 6

And it’s not just manufacturing companies. The Economist reports: “International law firms have closed some or all of their offices in China. Orrick, Herrington & Sutcliffe, an American one, said on March 22nd it would shut the Shanghai office it opened 20 years ago. Another, Akin Gump Strauss Hauer & Feld, plans to exit China altogether this year. Some global investment banks are pruning their Chinese staff. So are a few large accountancies and due-diligence groups.” 8 Given that a high percentage of such professional services company clients in China are MNCs operating there, this is not indicative of good fortunes for all MNCs in China.

Short of world wars and communist takeovers, rarely do companies with global presence withdraw from an entire country—particularly one that is the second largest economy in the world. Something is seriously wrong in China and that means opportunity for its competitors.

Revving The Economic Engine

Rationalizing Its Supply Chain

The crown jewel of China’s manufacturing prowess is its vertically integrated domestic supply chain—often having component makers just down the street, or another town over. This is a huge competitive advantage that makes for quick, accurate and competitive quotes, while adding manufacturing agility and cost savings. Example: component inventories can be low or zero for a final assembler if the component manufacturer is less than a half hour away.

The imposition of tariffs by the United States largely negates this competitive advantage and Chinese manufacturers have responded by off-shoring downstream production. One destination is the Bamboo Network (Southeast Asia’s ethnic Chinese business network) countries. This avoids the US tariffs but leaves Ethnic Chinese ”Bamboo Network” Chinese manufacturers with diminished verticality in their upstream suppliers requiring large intermediate component inventories, added shipping costs and vastly extended lead-times.

Another destination is near-shoring production to Mexico and adjacent countries. One prime example is Hangzhou China-based upholstered furniture maker Kuka Home, which has manufacturing in Monterrey, Mexico.10 In 2024, sourcing components from their Monterrey Mexico facility, they leased a warehouse in Dallas Texas for final assembly and shipping of mattresses to US customers. Unlike complex electrical products, mattresses have far fewer component and have a very high domestic (Americas sourced) content. But as nearshoring gathers momentum, commercial necessity compels Chinese component makers to take the plunge and follow their customers to the Americas to support a variety of complex products. The result will be beneficial to both the Chinese companies and Mexico, which will see sorely needed domestic verticalization of manufacturing.

Further Opening Its Market

“Our China-Pacific Business” was another China hey-day refrain when the promise of a billion new consumers was being brought within reach. It referred to how China sales volume became the leading revenue line item of an MNC’s Asia Pacific portfolio. While it is true that multinational companies came to China for cheap labor, they also came to access the world’s largest market by population. To stem the aforementioned multinational company exodus, the Chinese government will need to take concrete steps to reverse the perception, if not the reality, that the promise of a billion consumers will hereafter be kept just out of reach for multinational players. China must allow foreign players to drink from the well.

MEXICO’S PULL FACTOR

The more clever and aggressive countries that aspire to join the manufacturer-to-the-world club are already busy decoding their formula for success and taking action. Pro-active rather than reactive strategies have drawn manufacturing to diverse countries ranging from Ireland to Costa Rica, which enjoys the highest GDP per capita in Central America after Panama.11

To compete more aggressively and effectively in the scramble for manufacturing orders it is important to first take stock of Mexico’s strengths and weaknesses, and determine where it fits in a North American nearshoring model.

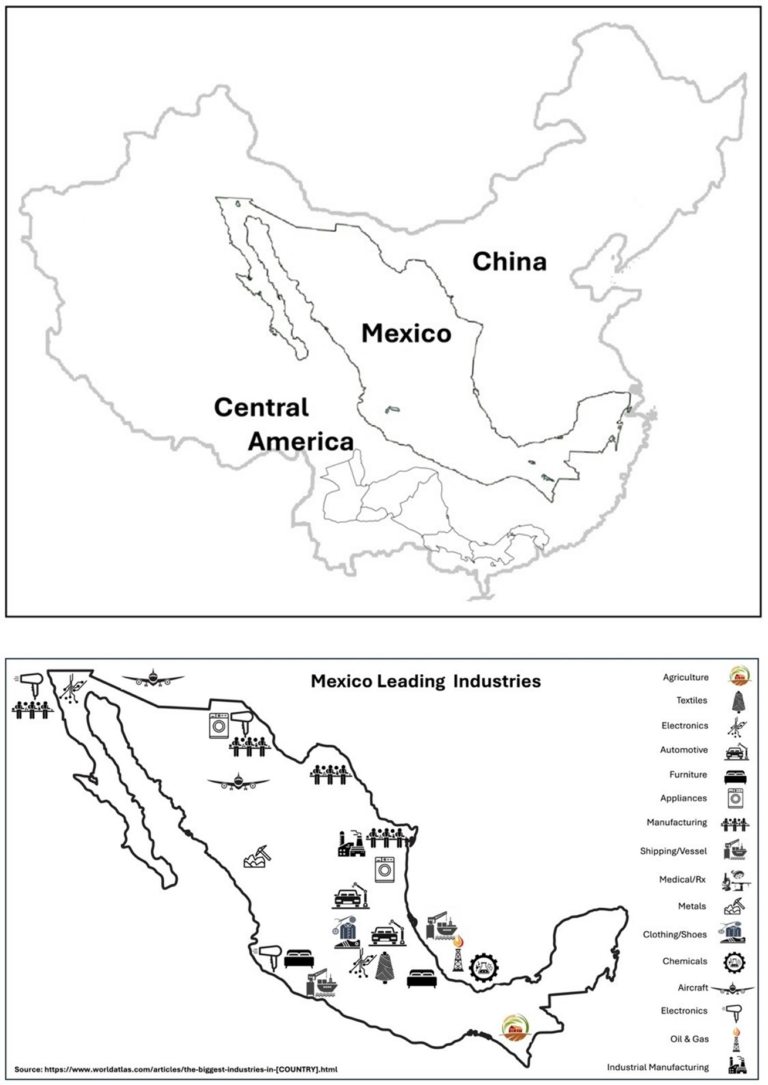

Comparative Geography

In addition to having one of the world’s largest populations, China also comprises an enormous land mass. While the Gobi Desert, mountainous regions and Tibetan Plateau are largely uninhabited, China’s 14,500 km coastline supports many of the world’s largest commercial ports, located on the main arteries into China’s heartland. Nevertheless, by comparison, considering similar +/- variables, China dwarfs Mexico and Central America combined.

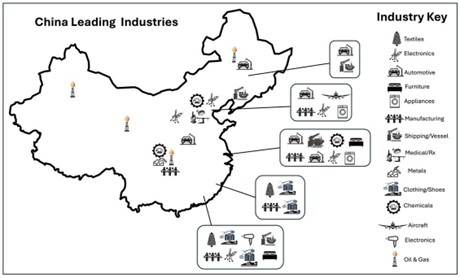

Comparative Capabilities

Mexico already enjoys a relatively respectable industrial base that is disbursed across the country. Mexico’s membership in NAFTA/USMCA has brought in manufacturing from North America, mainly in the form of OEM component manufacturing.

But the USA is also a member of CAFTADR FTA (Dominican Republic-Central AmericaUnited States Free Trade Agreement), which puts the entire geography from the US-Mexico border to the Panama-Columbia border under favored trade status. And these Central American countries bring their own capabilities to the table.

Taken as a whole, it is more practical for Mexico to see itself as a leading country within a regional economic zone—pursuing strategic specialization for acquiring a bigger share of the manufacturing vertical—than trying to become another China on its own. Most importantly, this region possesses two competitive advantages that China can never beat: adjacency to the United States and vastly lower national security concerns versus those about the CCP.

Industry Dispersion Across Mexico

Industry Dispersion Across Central America

Getting In The Game

Of the change in US imports from China 2017 to 2022, so far Mexico has picked up only about 5% of the business that moved out of China.12 Given the geographic advantages, geopolitical pressures, supply chain imperatives and government trade incentives on offer, this low number should be disappointing to Mexico; that it is allowing this once-in-a generation opportunity to pass it buy. However, with the right focus, determination, planning and actions Mexico (and the region) can position itself as the manufacturing destination of choice for serving the North American market and the world.

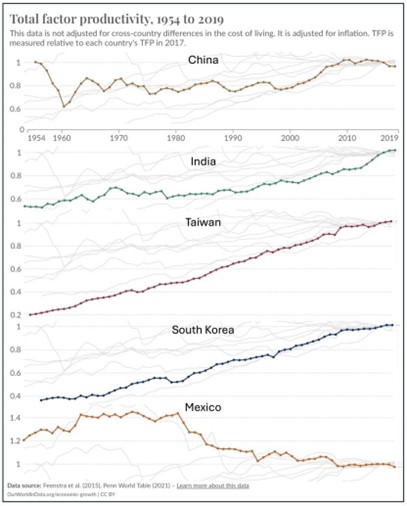

Comparative Productivity

Total factor productivity (TFP) determines how much is produced versus what is needed to achieve that result: dividing total production (output) by average costs (inputs).13 Unfortunately, while Mexico’s competitors have been improving their TFPs, Mexico’s has been declining.

While national TFP figures may not be the most common go-to measure for corporate analysts, the reality of lower productivity will eventually come out through other measures. Mexico, Inc. (government, business and academia) needs to make a concerted effort to reverse this decline and begin at least trending in the same direction as its global competitors. Mexico needs to be far more aggressive in making productivity changes that offset the factors driving the decline: aging population, short-term political sugar-rush increases in the minimum wage, among other things. Investment in technology, incubating innovation, and cultural and social conditions are all part of the mix. Total Factor Production Trend, Country Comparison.14

MEXICO’S BATTLE PLAN

China’s transformation from an isolated economic basket case to a globally integrated economic powerhouse took the better part of 40 years and a monumental effort by the Chinese people and government, and the global business community. While Mexico is further along in its industrialization journey than China was at the time, the hard work, persistence and sense of national mission required for economic transformation still needs to happen for Mexico. In order to earn its share of the global manufacturing pie, among the many changes that need to happen, there are some immediate strategic and tactical steps that can accelerate the process.

Prudent Risk-Taking

Mexican enterprises tend to be too risk averse for the global game and need to become more risk tolerant with investments. Most companies want to see a certain amount of sales and then invest in high-speed, automated equipment that lowers cost. The problem with this philosophy is that they never receive the purchase order to begin with because current cost is too high. They should investigate and commit to purchasing cost-lowering equipment, provide to US client both current cost of product and future cost of product once the equipment is installed, and take the plunge.

Capitalizing On Available Incentives

Net export cost can be reduced through fully leveraging favorable taxation laws designed to encourage export competitiveness. Aspiring exporters must obtain IMMEX status. IMMEX certification allows the duty free, and tariff free importation of materials provided they are exported in a finished product—where the majority of the value-added cost is Mexican. While this is an additional accounting and bookkeeping burden, the competitive benefits far outweigh the administrative cost.

Strategic Collaboration

This involves cleaning up and streamlining the supply chain. Downstream manufacturers should collaborate with other Mexican factories in the same industry for combined volume purchases in order to enjoy volume discounts. And, go direct to raw material suppliers, such as a steel mill or aluminum producer, which then eliminates a distributor who handles smaller volumes but at a higher price (usually 20% or more).

Entering into joint ventures and formal strategic collaborations are other ways to enjoy economies of scale, cost-effectively import technical capabilities and even enhance market access.

Up The Game: Go On The Offensive

Mexican companies must become aggressive and willing to compete on both the basis of time and ease of doing business…for their customers! Faster turnaround on inquiries and quotations are imperative. But they must also be proactive. Ask for meetings, visit prospective customers. Go on the offensive and win the business, instead of waiting for customers to have a desire to buy from Mexico and to discover them.

Taking the operation to this level involves visiting retail stores and looking at your customer’s products on shelf, comparing them to the competition and watching consumers interact with them. All things being equal, a conversation with a potential buyer where a supplier confidently demonstrates an understanding of the customer’s products, business and consumers will win purchase orders, guaranteed.

And the next level after that? Create opportunities. Begin self-assessing performance based on RONA (Return On Net Assets), which will clarify and sharpen the commercial vision: how can we get this factory making the very highest returns possible? Select a new product for which the factory has the requisite capability, reverse engineer the product and go through the process of building out a supply chain with other factories to develop a cost. Then contact US companies and proactively ask them if they have considered Mexico for that type of product. Give them the landed cost right up to their loading dock and let them come to the conclusion that when transportation cost, duties and tariffs are considered, Mexican companies can be competitive with China on cost—with a much shorter lead time!

Effective Governance

Like the Chinese government, the Mexican Government has a key role to play in both setting a national vision for Mexico and supporting achievement of the mission to proudly join the manufacturer-to-the-world club. Here are just some of the things that can be done in the short and medium terms:

• Lower electricity costs by opening Mexico to large imports of natural gas. Mexico’s next-door neighbor, the USA, is the largest natural gas producer in the world, by far. This is a huge competitive advantage since China imports 80% of its oil. Natural gas via pipeline will lower the cost of electricity and subsequently the cost of manufacturing across all industries.

• IMMEX certification can take up to a year—way too slow for the global quick and the dead competitive landscape. Shortening and streamlining the IMMEX certification process, and expanding tutorials and training courses for IMMEX certification, will accelerate Mexico’s export economy development.

• Place high tariffs on imported products that threaten Mexico’s industries. Lower tariffs on base materials so that the cost of manufacturing in Mexico is lower.

• Find unorthodox ways to control the cost of factory labor. In 2023 Mexico labor costs rose 20%, which decreases the labor cost advantage Mexico now enjoys with China. If labor is in short supply in a region, incent economic migrants heading to the US border to stay in Mexican where they can acquire a skill and make a good living.

• Provide economic incentives in key industries that will increase the made in Mexico content of products: fractional AC motors used in tabletop appliances, vacuum cleaners, power tools, lawn and garden tools, etc.; small DC motors and small lithium-ion batteries and chargers used in hand-held power tools and small appliances like toothbrushes. Additionally, proactively court companies from Taiwan, South Korea, Singapore, Japan, and Hong Kong that have multiple factories throughout China and Southeast Asia to start joint ventures with existing Mexican companies and build new factories in Mexico. Incentives could include discounted land and low company income taxes, among others. The goal is not immediate tax revenue (that will come in time), but the emergence of a long-term commercial base that rivals the production centers of Asia.

CONCLUSION

The operative word in Mexico Winning Its Share Of The Global Manufacturing Pie is “win.” As illustrated in the first in our series of articles on nearshoring, Mexico Must Rise To The Challenge of Nearshoring, “Think global, act local,” is all about multinational companies accessing consumers in new international markets. Whereas, joining the manufacturer-to-the-world-club is all about “Think global, act global.” There is a smart, well-established and competitive game out there for the global manufacturing pie and Mexico needs to jump into that game aggressively, with both feet and for the long term. When Mexico plays its hand right it can tip the table, steering the flow of global investment, technology transfer and customer orders to its favor.

Our next instalment in this nearshoring series will look at various roadmaps for Mexico’s transformation to global competitiveness, including fielding its greatest untapped resource: overseas Mexicans. Overseas Chinese were an essential element with taking China’s manufacturing global, but Mexico has yet to effectively mobilize and leverage overseas Mexicans’ leadership skills, global savvy and international connectivity in taking Mexico’s global competitiveness to the next level.

End Notes

1 “The Impact of the Global Crisis on China and its Reaction (ARI),” Ming Zhang, Deputy Director of the

International Finance Division, Institute of World Economics and Politics, Chinese Academy of Social Science, Beijing, 14 April 2009

2 “You Can’t Go Home Again,” Thomas Wolfe, Harper & Brothers, 1940

3 “How much will China risk for Taiwan? – Sara Paine (Naval War College), March 2024 interview, https://www.youtube.com/watch?v=qSTuahfAZf0

4 “Nixon’s ADVICE On Dealing With Chinese Leaders,” Richard Nixon Foundation YouTube channel, https://www.youtube.com/watch?v=GjnkOsDAAfo&t=5s

5 Maria Bartiromo, host of Mornings with Maria, “The US could ‘cripple’ China this way, expert details,” aired May 10, 2024 ( https://www.youtube.com/watch?v=gy3t_kHK4xQ )

6 “US labor official calls on companies to exit China’s Xinjiang,” Reuters, April 30, 2024

(https://www.reuters.com/world/china/us-labor-official-calls-companies-exit-chinas-xinjiang-2024-

04-30/ )

7 “China commerce ministry bans some US firms from import, export activities,” Reuters, May 19, 2024. (https://www.reuters.com/markets/china-commerce-ministry-bans-some-us-firms-importexport-activities-2024-05-20/).

8 “The mind-bending new rules for doing business in China,” The Economist, Apr 3rd 2024, (https://www.economist.com/business/2024/04/03/the-mind-bending-new-rules-for-doingbusiness-in-china )

9 “‘Low price’ is the word at China’s largest trade show,” By Ellen Zhang and David Kirton, Reuters, April 14, 2024 (https://finance.yahoo.com/news/low-price-word-chinas-largest- 081859901. html?fr=sycsrp_catchall )

10 “Kuka Home’s 2.3-million-square-foot Mexico strategy,” Jean Marie Layton. Furniture Today, April

26, 2022 ( https://www.furnituretoday.com/business-news/kuka-homes-2-3-million-square-footmexico-strategy )

11 “Gross domestic product per capita in Central America in 2022, by country,” Statista, 2022,

(https://www.statista.com/statistics/1399535/gross-domestic-product-per-capita-in-centralamerica-by-country/#:~:text=As%20of%202022%2C%20Panama%20registered%20the% 20highest%20Gross,lowest%20GDP%20per%20capita%20with%20less%20than%206%2C000. )

12 UN Comtrade | Reuters, Sep. 27, 2023 | By Riddhima Talwani

13 “What is Total Factor Productivity (TFP)?” WallStreetMojo, April 12, 2024,

( https://www.wallstreetmojo.com/total-factor-productivity/ )

14 “Our World in Data,” 2019, ( https://ourworldindata.org/grapher/tfp-at-constant-national-prices-

2019 )