20 Nov 2023 The Geo-Political Climate Demands Immediate Nearshoring

Why it's Vital for Businesses in China to Act Now

Written By Jeffrey Cartwright, Shoreview Managing Partner | 5 min read

With the US-China Trade War now in its fifth year and the global supply chains disrupted due to the pandemic, businesses are increasingly exploring Nearshoring as a risk reduction strategy. However, recent developments on the world stage, such as Russia’s invasion of Ukraine, China’s aggressive stance on Taiwan, and the Hamas-Israel conflict, have transformed Nearshoring from a mere trend into an urgent imperative. In this article, we present compelling evidence that supports this conclusion.

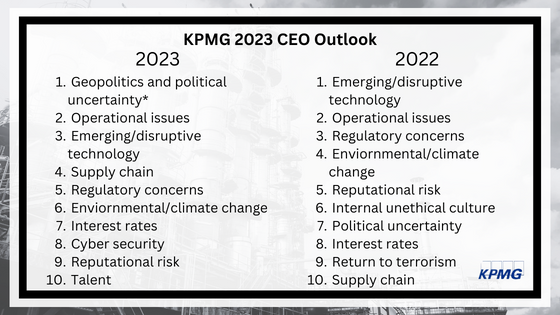

Recent Survey of CEOs Shows Great Concern Over Geopolitical Uncertainty with Operational and Supply Chain Risk Also High

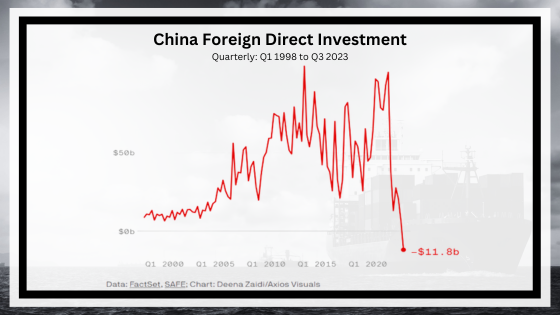

Foreign Direct Investment

Decades of investment have been poured into Chinese factories and infrastructure by various companies. This lucrative venture was primarily driven by China’s enticingly low labor costs, especially in comparison to US manufacturing. As a result, numerous factories were established with foreign funds. However, for the past twenty years, Chinese factory labor costs have surged at an alarming double-digit annual rate. Remarkably, China’s labor costs have surpassed those of Mexico, making Mexico a more cost-effective alternative. The accompanying chart paints a grim picture of foreign direct investment, which has plummeted sharply since the outbreak of the pandemic. Shockingly, for the first time in a quarter-century, this investment has turned negative, reaching a staggering –$11.8 billion in the third quarter of 2023.

Foreign Firms Are Pulling Out of China

In a startling report by The Wall Street Journal, it has been disclosed that an astounding $160 billion in total earnings has been withdrawn by foreign firms from China within the last six quarters. This dramatic shift marks a significant departure from previous practices, as foreign companies had long reinvested their profits into the Chinese market to support growth and advancement. Consequently, this mass exodus of funds is now posing a grave threat to the stability of the Chinese currency, the RMB. In a further blow, a recent article by Reuters on November 6, 2023, revealed that a staggering 40% of multinational corporations surveyed by the European Central Bank expressed plans to relocate their production facilities to more accommodating countries in the foreseeable future. The primary reason behind this disconcerting trend appears to be the mounting concerns and risks associated with doing business in China.

Relocating Sourcing from China to Mexico Is Complex Yet Productive for Many Companies

The US and China are engaged in a trade war that has been ongoing for 5 years. Despite the passage of time, the situation shows no signs of improvement. In fact, geopolitical tensions are increasing and there is a constant risk of disruptions to the supply of goods from China. The Biden administration and the Chinese government continue to announce new restrictions on traded goods on a weekly basis. Recent examples include semiconductors, rare earth metals, and graphite.

If your company is concerned about the growing aggressiveness of China, particularly regarding Taiwan, it may be wise to consider exiting China and instead opt for Near-Shoring to Mexico or Re-Shoring back to the United States. However, it’s important to note that these alternatives come with their own set of challenges and will require significant resources. Executive leadership will need to be closely involved in the process to ensure that the change effort is properly staffed by individuals who are open to change, rather than those who may resist it due to the potential impact on their roles or status within the company.

Implementing the strategy of Re-Shoring or Near-Shoring will likely require additional resources, both internally and/or externally. If external resources are needed, it is crucial for executive leadership to carefully choose a consulting resource with a proven track record of delivering results and hands-on experience in the target country. Shoreview Management Advisors is a trusted advisor that has been successfully Nearshoring from China to Mexico for the past 5 years, even before the Trump Tariffs and trade war with China. The executives at Shoreview boast over 25 years of experience in manufacturing and sourcing products in Mexico.

Contact us today if you’re serious about exiting China and moving your sourcing to Mexico.