01 Feb 2024 Unprecedented Challenges in a World of Storms Requires Actions while there Is Still Time to Plan and Execute Re-Sourcing

Unexpected Events Cause Disruptions in Days and Weeks, not in the Months and Years, that Are Required to Build Supply Chain Resilience.

Written By Jeffrey Cartwright, Shoreview Managing Partner | 5 min read

On October 7th, Hamas launched an attack from Gaza on southern Israel. Israel responded with an invasion of Gaza. The Houthis in Yemen have responded with attacks on shipping through the Red Sea at a bottleneck known as the Bab al-Mandab. It is 31 miles long and 16 miles across at its narrowest. Well within the range of missiles and drones from various sites in Yemen.

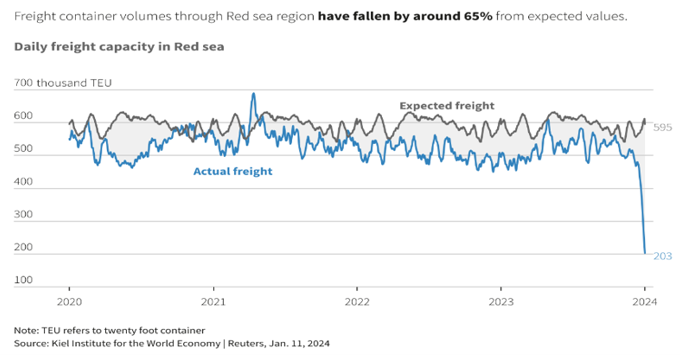

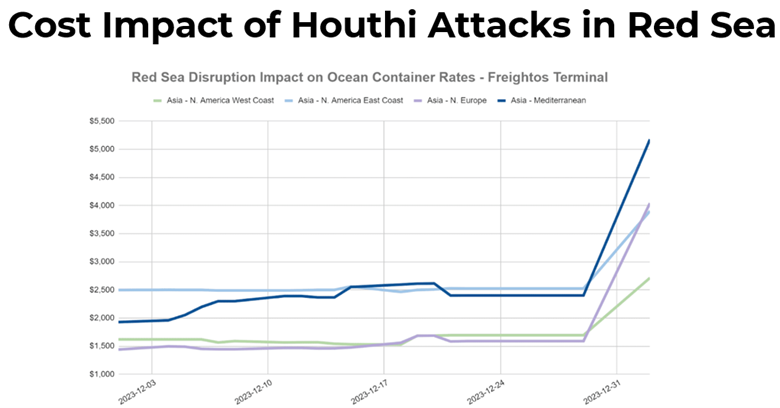

The short-term effect, within weeks, is a dramatic decrease in shipping (65% down) and a doubling of ocean shipping costs from China to Europe (up over 250%). Because shipping schedules are tightly planned, and the number of containers available are globally planned to match shipping volumes, there are effects on other shipping lanes as shown in the chart below. This will get much worse.

There are reports from China of insufficient containers available to load as they are on ships that are spending longer time at sea. Rates from China to the US West Coast have increased by over 60% – so far. These increases have occurred in less than a month, well shorter than any planning window for any software or the best of logistics companies. Better supply chain planning in the near term is simply incapable of foreseeing or reacting to such dramatic changes in such a short period of time. Further effects include the closing of a number of factories throughout Europe due to inability to receive component parts in time to meet production schedules.

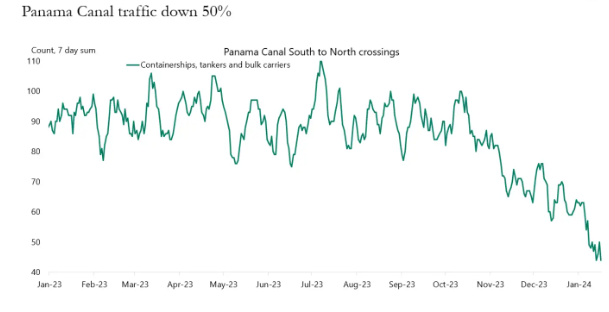

The Panama Canal Expansion Was Completed in 2017 to Facilitate the Shipment of Goods from Asia to the US East Coast. However, Drought Conditions Have Reduced Traffic through the Canal by Over 30%.

The timing on this was more incremental, and therefore, disruption of the flow of goods could be offset by resuming US West Coast arrivals from Asia and trucking or rail transport across the US to customer destinations. This results in an increase in the cost of importing products from Asia to locations closer to the US East Coast. 40% of all US Container Volume flows through the Panama Canal, and the effect of the Red Sea turmoil has increased costs from Asia to the US East Coast by around 60% so far.

Choking Global Trade

For those companies reliant on buying from or selling to China, the Strait of Malacca should be of grave concern. The Strait of Malacca is nearly 500 miles long and is 40 miles wide at its narrowest point. However, the water depth is shallow at the south end of the strait, which narrows the shipping lane itself to 1.7 miles across. One terrorist group like the Houthis with missiles and drones could wreak havoc on shipping. Conflict between China and Taiwan could result in closure of the strait from a mine laying ship or from a single submarine. If so, the effects on Global Trade would be much more dire than a mere disruption.

The volume of trade passing through the Strait of Malacca is enormous. $3.5 Trillion worth of products transit each year. Two-thirds of all China trade ships through the strait, and China is dependent on the Middle East for 80% of its oil.

The time from the beating of the war drums to outright conflict is historically very short. The assassination of Archduke Ferdinand on June 28th, 1914, to the start of World War I on July 28th, 1914, was just 30 days. Germany signed a non-aggression pact with the Soviet Union on August 23rd, 1939, and invaded Poland on September 1st, 1939, or one week later, to start World War II in Europe. Relationships between Japan and the United States had been rocky for some time, but the Japanese attack on Pearl Harbor to start World War II was a surprise. More recently, North Korea invaded South Korea on June 25th in a surprise attack, and the US deployed troops to South Korea 5 days later.

For those who think things might be different this time, Russia invaded Ukraine with no notice following about a month of threats. Hamas invaded southern Israel with no notice.

If China attacks Taiwan (and it reserves the right to use force if necessary to reunify Taiwan and China), it will not be with months of notice so all the importers in the US will have time to plan re-sourcing of their supply chains. Also, recall that President Xi directed his military to be ready to invade Taiwan by 2027, according to CIA Director Burns on February 3rd, 2023.

Geopolitical Risks Are Only Increasing

Importers of finished products need to consider Re-Shoring to the US or Nearshoring to Mexico to offset the increasing risk of a major disruption to the flow of goods.

As a caution Mexican companies should source components closer than Asia, if possible, for multinational companies desiring to eliminate their reliance on China. Being unable to obtain a key component during a crisis results in the total shutdown of the final manufacturer if there is a cessation of Pacific trade due to an outbreak of armed conflict between China and Taiwan. Since the beginning of the Trade War, Southeast Asia has been the beneficiary of the movement of production from China. However, if 60% plus of the Asian factory is sourcing parts from somewhere other than China, that solves a tariff problem but does not achieve the objective of reducing reliance on China and minimizing risk.

Transitioning from China being the factory of the world to a more regional manufacturing strategy will have its challenges, but the rewards will be great and enduring for decades.

Re-Sourcing to the US (Re-Shoring) or to Mexico (Near-Shoring) has its difficulties and requires resources. Shoreview Management Advisors is of value to both Mexican factories looking north for growth opportunities and to US companies looking for reliable, cost-effective sources of products.

For the past 5 years, Shoreview has been Nearshoring from China to Mexico, having served many clients even before the Trump Tariffs and trade war with China. Shoreview executives have over 25 years of experience in Mexico in manufacturing and sourcing of products. Please contact us if you’d like to learn more.