25 Sep 2025 Why Mexican Factories Fail at Nearshoring and How They Can Succeed

Written by Jeffrey Cartwright, Managing Partner – 5 min read

The Promise of near shoring and the persistent struggles

The U.S.-China trade war has upended global trade, with American tariffs on Chinese goods ranging from 30% to 55%. These tariffs have caused U.S. imports from China to fall by over 30%, prompting companies to look for alternative suppliers. Mexico, with its geographic proximity, shared time zones, leveraging of the USMCA, and cultural ties, was poised to capture a significant portion of this exodus of business. Yet despite these inherent advantages, Mexican manufacturers have gained remarkably little ground in the nearshoring opportunity.

Despite a narrative of optimism, several material inefficiencies and cultural disconnects prevent Mexican factories from becoming competitive alternatives to their Asian counterparts. Read on to explore why Mexican factories frequently fail at nearshoring and learn actionable strategies for implementing operational excellence that can level the playing field.

material costs are a major factor in why Mexico isn't winning against china

Labor costs in manufacturing are often perceived as the key driver of competitiveness between Mexico and China. However, closer scrutiny reveals that labor accounts for only a small fraction of overall production costs.

More so than labor, Mexico’s strong relationship-oriented business culture is a huge detriment to its factories being able to compete against Asian factories (Vietnam and others) in arriving at a competitive product cost. Relying on existing relationships with distributors results in a significantly higher cost of raw materials and components. Labor costs are a fraction of the total cost of most products so: The competition therefore is supply chain against supply chain.

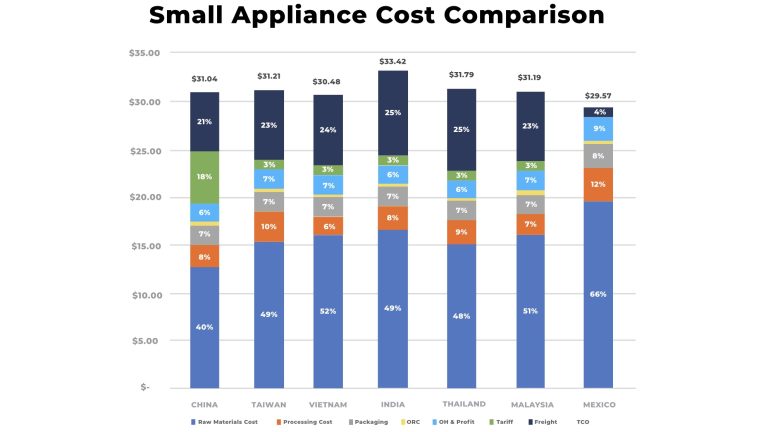

The chart below is an actual example of comparative pricing for a small appliance. This was chosen because the number one category of product that China exports to the world is small appliances, and therefore this is the category where Mexico can gain the most from Nearshoring.

Note that in all cases, the majority of manufacturing costs are raw materials (the lower blue portion of each bar). Mexico has the highest materials costs, and that is the major reason for being non-competitive at the factory level. This article specifically highlights that cost disadvantage of many Mexican factories not changing how they source and purchase materials when competing against China and Southeast Asia.

Tariffs greatly favor Mexico as it is assumed that there is no tariff on Mexico as the products comply with USMCA content requirements. Since tariffs are not finalized, and beyond a factory’s control, it is best to focus on what is changeable. The largest product cost opportunity is materials, and it is therefore the area in which factories and their ownership must work the hardest and most aggressively.

The Opportunity with Small Appliances: Mexican manufacturers must focus on reducing material costs to close the competitive gap in this potentially very lucrative product space. Transitioning to direct sourcing strategies and eliminating inefficiencies in the supply chain are vital steps that could position Mexico as a credible alternative to China for this product category.

Sourcing vs. Purchasing: A misunderstood divide

A significant barrier to reducing costs is the frequent conflation of sourcing and purchasing. While these roles overlap to some degree, their objectives and required expertise differ radically, with clear implications for nearshoring competitiveness.

While buyers will tell you that they are great negotiators and buying at the lowest price, they generally are not. Purchasing focuses on securing raw materials and components to avoid disruptions to manufacturing. Buyers prioritize on-time delivery, adequate buffer inventory, and consistent quality for materials. Price competitiveness is typically secondary to reliability as disruptions in supply chains can halt production and compromise delivery schedules.

Given that competitive bidding is done at all, it is generally controlled by the buyer either in writing the Request for Proposal (RFP) to exclude unknown suppliers or when a lower bid is obtained, it is hidden from management so as not to embarrass the buyer from not having the lower price earlier or to protect the buyer from the risk of poor delivery or poor quality. Testing and validating a new supplier is sometimes difficult and time consuming, so rarely done – a grave mistake.

Sourcing is substantially different in that all of these things above apply at a later time in the process. Sourcing is a strategic, proactive function involving the identification and qualification of suppliers, competitive bidding, and supplier development. It requires dedicated resources and time to evaluate market options, improve pricing, and eliminate inefficiencies.

Buyers that have full schedules and demands on their time simply do not have the discretionary time to pursue alternatives. It also requires challenging the way things have been historically done. Distributor markups and catalog pricing inflate costs significantly, highlighting the need for direct factory sourcing strategies. Distributors typically operate at a 25-30% margin, which directly impacts the competitiveness of the final product against similar products from China. This margin often makes the cost advantage of nearshoring negligible. Worse still, distributor catalogs are an even more expensive source for components, with pricing often 10-12 times higher than sourcing directly from factories. Reliance on these costly sourcing methods is a major factor in the high material costs faced by Mexican factories. Transitioning to direct factory sourcing is an essential step to regain cost competitiveness.

However, finding these factory sources requires time. Each item in the bill of materials must have a unique sourcing strategy. Identifying a factory is just the first step, building a relationship with the factory, ensuring technical understanding of the product requirements, and competitively bidding with multiple factories is necessary to obtain the most competitive price. During this extended process, ensuring quality, capacity, and delivery capabilities are also necessary. When one of these capabilities is lacking, supplier development is required to ensure a reliable source.

Note that the activities of a purchasing person are quite repetitive and require analysis of information such as demand, volume, and transportation. Sourcing requires innovation and creativity as well as true negotiating skills, which are normally not a significant part of the purchasing process. Effective sourcing is a time-consuming process, and it cannot be done without dedicated resources. Asking someone to do it and their full-time role will result in it being the last thing done each day rather than the first thing or even the 10ththing done that day. It is a critical priority due to a major change in cost from tariffs such as a 20% or even 55% cost increase or due to ongoing supply chain disruption, so it should be resourced with the right people, adequate time, and funds and nothing must be allowed to interfere with the effort.

The second issue with using the purchasing resources is availability of time. In any ongoing business, there are a variety of daily challenges, each of which require the attention of the existing team. The Tyranny of the Urgent (day-to-day emergencies, tasks, and meetings) will crowd out any effort at competitively sourcing will not be the priority issue of the day or even the 10th issue of the day, it will be the thing done when all else is back in control, which is to say many days later, if at all.

If securing new business for the company is an urgent priority then the resources assigned to it, must be dedicated to it. Trying to do one’s current job and do another one that is far more complex and time-consuming is impossible.

The expectations of U.S. buyers have evolved significantly, shaped by years of sourcing from China. Mexican factories must understand and adapt to these expectations to compete effectively.

- Response Times: U.S. buyers expect quotations within 2 days and quick execution of Non-Disclosure Agreements (NDAs). Mexican factories often require two weeks or longer for these processes, creating an impression of inefficiency.

- Pricing Transparency: Mexican factories frequently submit inflated initial bids, expecting drawn-out negotiations. U.S. buyers perceive this as a lack of competitiveness and often abandon the process entirely.

Actionable Insight: Streamlining quotation and negotiation processes is essential to meet global standards. Digital tools, automation, and U.S.-specific training programs can help align Mexican factories with buyer expectations.

Compliance with export readiness programs

Programs such as IMMEX and VAT exemptions are critical to achieving cost competitiveness in exports. These programs allow manufacturers to avoid unnecessary costs, such as duties and tariffs, ensuring Mexican factories remain competitive against their Asian counterparts.

However, many Mexican factories fail to enroll in these programs proactively, forfeiting the cost advantages that are frequently the deciding factor in sourcing decisions. U.S. buyers are rarely willing to wait for Mexican factories to achieve compliance.

Recommendation: Compliance with export readiness programs is non-negotiable. Factories must prioritize proactive enrollment to secure their place in the supply chain and avoid losing opportunities to more prepared competitors.

Not investing in basic processes to reduce cost structure

There are a number of simple investments that can greatly reduce the cost of purchasing and the cost of manufacturing a product. A few simple ones for metal fabrication include: stamping presses (much faster than CNC laser cutting), (robotic welding 4 times faster than manual welding), slitting master rolls of cold-rolled steel and producing tubular steel in-house reduces inventory for multiple tube sizes and reduces the costs of steel tubing by at least 25%.

Also, most US companies that are looking at Nearshoring are only at the starting point. There is a lot of additional volume moving to the winning factory once the first product is successful. An example is that for the small appliance in the graph above, that product represents 60,000 annual units. The remainder of the product line is an additional 340,000 units. The subsequent effort required on the next item is much lower than the first item.

A reduction in cost structure to take advantage of the Nearshoring opportunity also improves profitability throughout the company’s product portfolio.

high hopes requires high commitment

In launching an initiative to become a successful Nearshoring partner, there must be an urgent and firm commitment to transition from the way the factory has successfully operated in Mexico to competing against China and Southeast Asia. In short, what has made your company successful in the past, will not be sufficient to make your company successful in 2025, 2026, and beyond.

Generally, factory owners have high hopes for Nearshoring, but low expectations for the key people who can improve the odds of success. Specifically, they expect their current purchasing people to be capable of sourcing and tolerate under-performance in this area for way too long.

To be successful at Nearshoring requires that the factory owners be involved in the critical level of detail in sourcing. They must insist that there is a project plan for each of the raw materials or components required. They need to insist that there is a list of potential suppliers and if there is not, they must be willing to expend the resources to develop that list by networking, attending tradeshows, or having a consulting firm conduct research to find these suppliers.

The factory owner needs to communicate high expectations by ensuring that there is a detailed plan and that it be executed in a timely manner. Setting benchmarks and holding people accountable to achieve those defined steps is key. Failure to set a rhythm for review of the plan will result in the plan not being accomplished. Failure to hold accountable the person who misses the date or fails to achieve the desired result will also result in failure. Priorities are communicated by how the leader spends his time, not by what he says. Tolerating missed dates is another way of communicating to the company that the owner has low expectations for success.

Shoreview management advisors: Transforming nearshoring potential

For Mexican factories to benefit from Nearshoring, they need to be more competitive than China or Southeast Asia. Proximity to the US alone is an insufficient advantage. Nearshoring success requires significant changes to materials procurement, operational processes, and market alignment. Tariffs go a long way tomoving economics in Mexico’s favor, but relying on that alone does not guarantee success. Shoreview Management Advisors is of value to both Mexican factories looking north for growth opportunities and for US companies looking for a reliable, cost-effective source of products. For the last 7 years we have been advising on Nearshoring from China to Mexico, having served many clients well before the Trump Tariffs and trade war with China. Prior to this latest imperative, Shoreview executives have over 25 years of experience in Mexico in manufacturing and sourcing of products as well as on the ground experience in Asia.

Our team specializes in diagnosing inefficiencies and designing tailored solutions to enhance cost structures, streamline operations, and build competitive supply chains. With deep experience across the U.S., Mexico, and Asia, we help our clients meet global standards while unlocking sustainable growth.

If you are a Mexican company and have tried to take advantage of the Nearshoring trend, but been unsuccessful, it is likely because of one of the above issues combined with choosing the wrong partner. Re-sourcing requires a significant effort and there are other firms that simply do not have either the experience or expend the effort of identifying, qualifying, and competitively bidding both the final product and the components necessary to build the product. Contact us now if you desire to grow and are willing to adapt to the demands of the US marketplace in order to greatly grow your sales by taking advantage of the exodus from China.